Ridgefield Market Report October 2017

October saw a decline in market activity, which is not uncommon given the usual frenzy that sets in as people start thinking about the Holidays. Encouragingly, the Median Value for single-family homes sold Ridgefield is up over the same time period last year, as were the number of properties that went under contract.

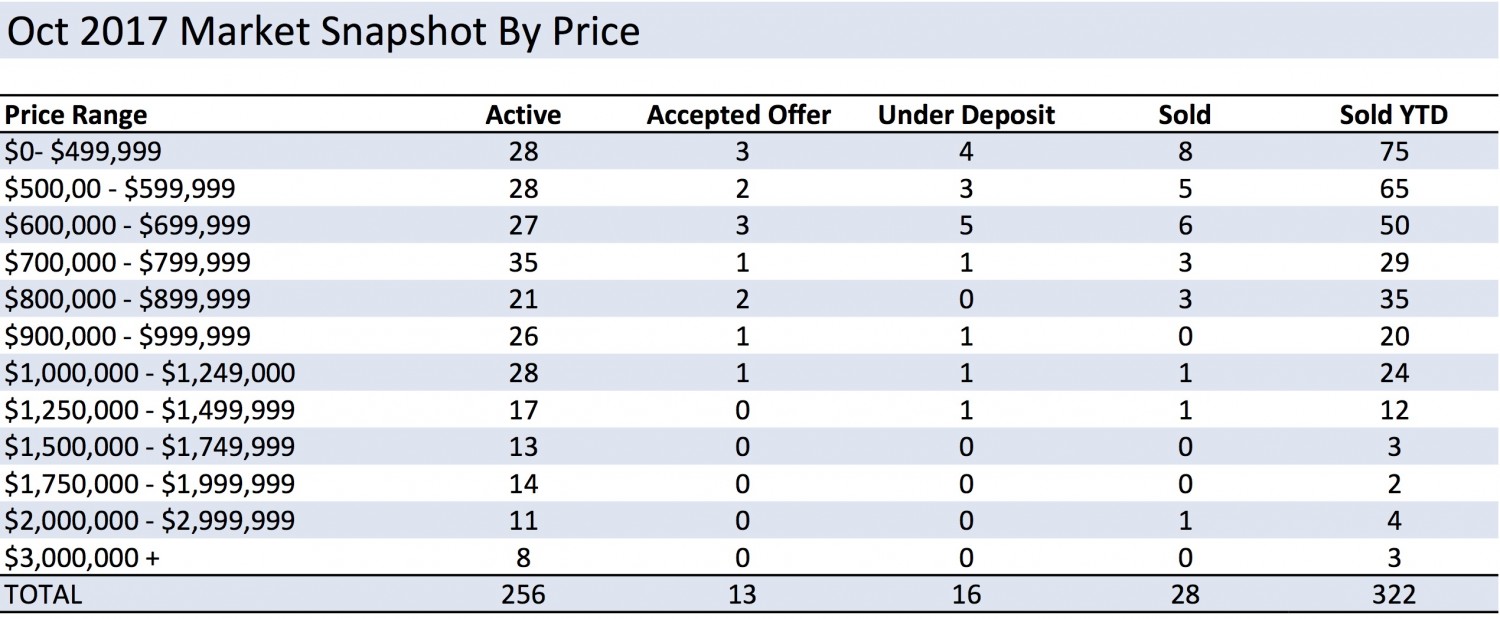

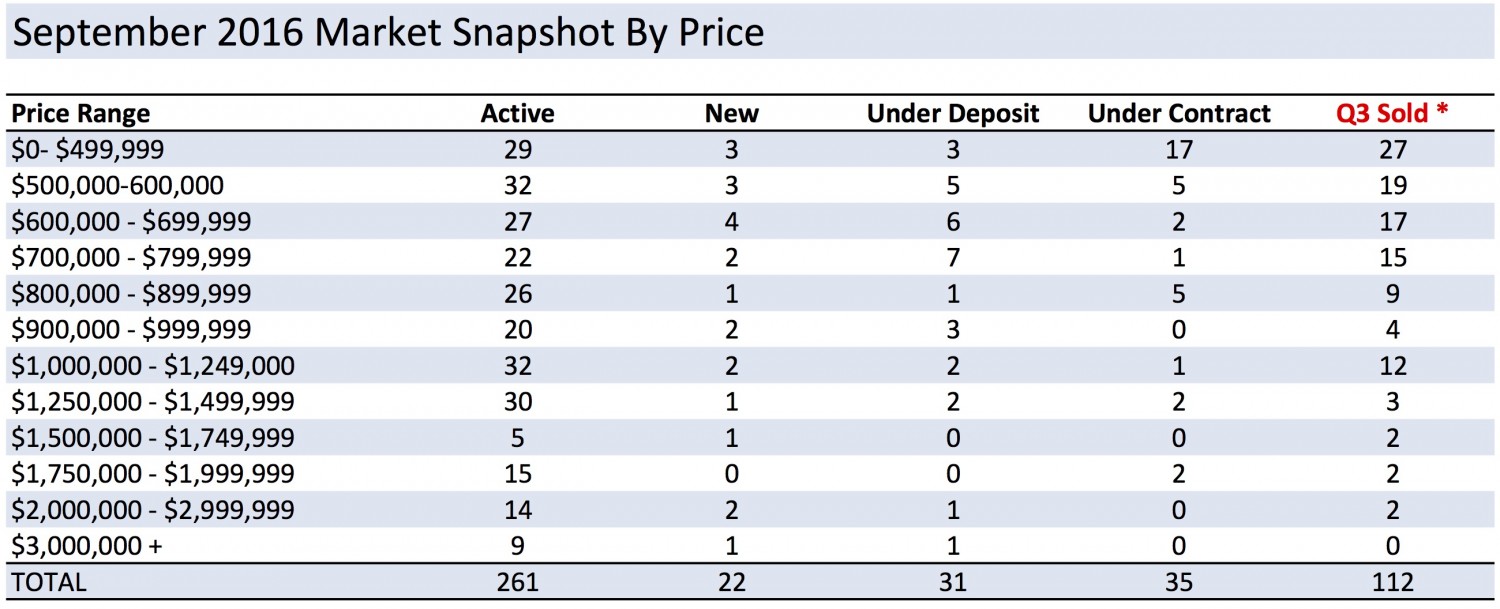

To see how October shook out in Ridgefield real estate , you can click for a snapshot of the market, or a breakdown by price.

MEDIAN SALES PRICE and CLOSED SALES

The number of closed sales was down over the same time last year with 28 properties selling as compared to 35 in 2016. This translated to a 20% decrease year-over-year. Overall however, 324 properties have sold compared to 304 by the same time last year, which represented a 6.6% increase. The Median Sales Price increased this month from $604,000 in October 2016 to $628,750 in October 2017. The year-to-date median value is on par with 2016 sitting at $640,000. Overall, all indicators point to the fact that it has been a steady year for real estate when compared with 2016.

PROPERTIES UNDER CONTRACT

The number of properties that went under contract increased over last year with 40 properties under contract compared to 27 in 2016. This represents a 48.1% increase. Overall, in 2017 we have seen an 8.4% increase in buyers jumping into the market, with 334 properties going under contract since the beginning of the year, compared to 308 last year.

DAYS ON MARKET and INVENTORY

We are still dealing with a shortage of properties available for sale this month. The months of inventory has decreased to only 7.9 months compared with 14.4 months last year. Forty new properties entered the market this month, compared with 51 last year, while the average days on market has decreased by 15% over October 2016 with homes spending an average of 149 days instead of 175 on the market before selling.

November and December are a traditionally slower time of year in the Ridgefield real estate market, but there are deals to be had if you’re looking to buy. If you’ve been thinking of selling, take this time to prepare your home by updating, cleaning and decluttering. Also, feel free to contact me for my complimentary Comparative Market Analysis to find out what your home’s worth in today’s market.

We continue to lead the market with the most comprehensive, proven marketing initiatives allowing your home to be in front of the widest audience possible on a local, regional, national and global level. We recognize your home is your biggest asset and both Buyers and Sellers experience an unparalleled level of customer service when working with us. Contact us today!