Ridgefield’s 2018 Mid Year Market Report

The Ridgefield Real Estate market continues to favor the buyer, but we have had a number of multiple bid situations on properties that are updated and priced correctly. Condition, along with location and proximity to Main Street, continue to be key drivers for sales across all price points. Buyers are becoming increasingly savvy about market conditions and trends due to the availability of data on public websites such as Zillow and Realtor.com. The threat of a mortgage rate increase does not seem to be affecting buyer decisions either as they bide their time and wait for the ‘right’ home.

The good news is that buyers are still willing to pay for properties they find desirable with properly priced homes selling at 96.5% of their listed price. As was the case last year, properties under $800,000 seem to hit the sweet spot in Ridgefield. The town continues to be a destination for families moving from areas within the metropolitan region, as well as relocating from other states due to our family-friendly environment, quality of life and access to major commerce centers. We also continue to see families move within Ridgefield, which is a testament to the ‘staying power’ of our town.

No Gain In Value

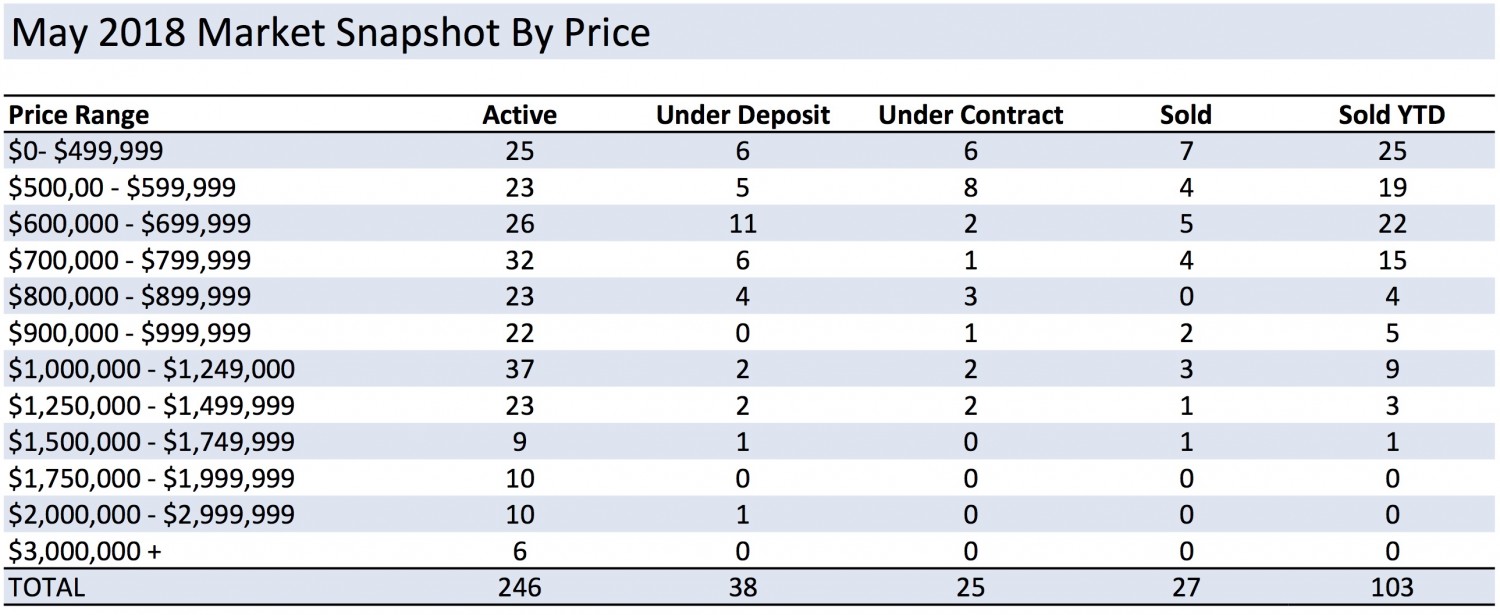

Overall, the Ridgefield real estate market continues to remain relatively flat across the board. A six-week weather delay created a sluggish spring market, resulting in lower unit sales and decreased overall volume sold. 147 homes were sold during the first six months of 2018, as opposed to 178 last year. The total sales volume registered a 21% decrease, ending the mid-year at $98,851,250. However, the median sales price remained on par with last year at $625,000 compared with $627,000 from January to June in 2017.

Where Are Buyer’s Buying?

As in previous years, during the first half of 2018 in-town properties are in demand with 42 percent of all sales occurring within a two-mile radius of Town Hall (considered Village center). The median sales price of these homes was $692,500, and the average sales price was $724,526 – both of which are above the town as a whole. Three of the four luxury condominiums valued at over $700,000 were also located in-town. These sales reflect the growing trend for more walkable properties close to restaurants, shopping and culture

Condo Report

There were 33 condominium sales in the first half of 2018 ranging in price from $135,000 for a one bedroom, one bath townhouse in Fox Hill to $865,000 for a three bedroom, two full and two half bath townhouse on Sunset Lane. The median sales price was $267,000, while the average sales price was $354,567. Compared to the first six months of 2017, the median sales price has risen by 14%, while the average sale price decreased by 12%. This discrepancy is due to a greater number of higher priced condominiums selling in the first half of 2017 compared to 2018.

The Luxury Market

Luxury market sales – defined as homes selling for $1.5 million and above – are comparable to the 2017 mid-year mark. So far we have seen one sale for $1,540,000 close, as compared to two during the same period last year. As of July 1st five luxury properties are either under deposit or in contract to close in the third quarter ranging in value from $1.745 million to $2.395 million. Historically, more luxury properties close in the third and fourth quarters. Anecdotally, interest in the upper price range remains strong with many homes experiencing a number of showings. Many luxury properties have also adjusted their pricing to attract the upper tier buyer looking for value and compelling offerings.

Activity Down In Fairfield County

After several years of growth, unit sales throughout Fairfield County slipped during the first half of 2018 with decreases noted across the board. Towns closer to Manhattan such as Greenwich, Darien and Norwalk saw modest increases in the median sales price, but still registered a decreased number of unit sales. While Fairfield County is still considered attractive for families due to the quality of life and great schools, the sense of urgency by buyers to make the move seems to have slowed. Looking ahead, market activity seems slightly higher than normal as we move into the summer months, which will hopefully equate to increased sales in the second half of the year.