Ridgefield July Market Report – Prices Remain High

Sales Slowing, But Prices Remain High

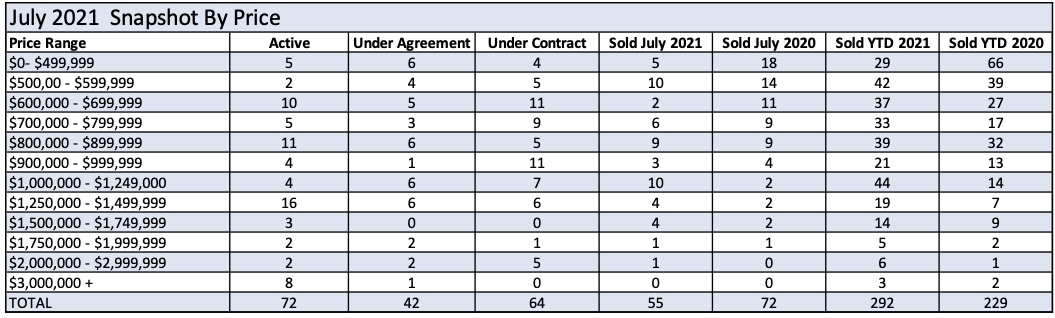

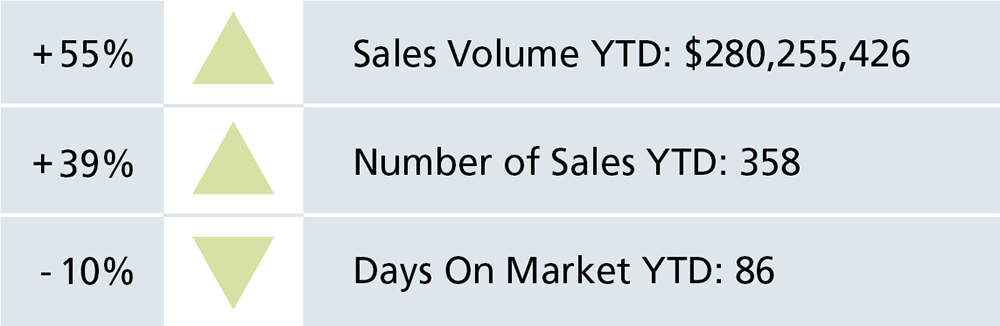

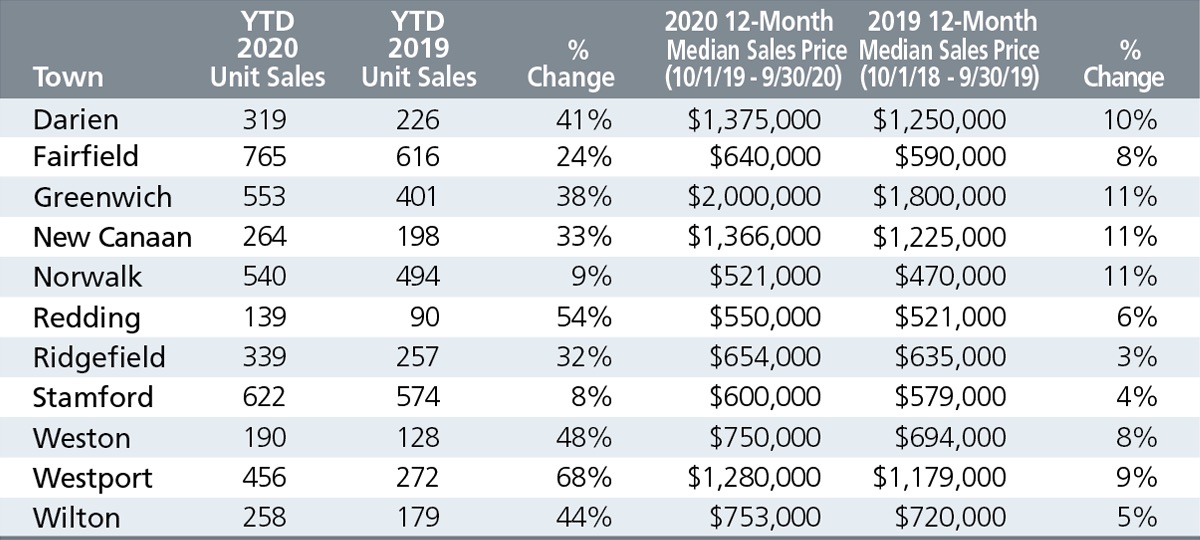

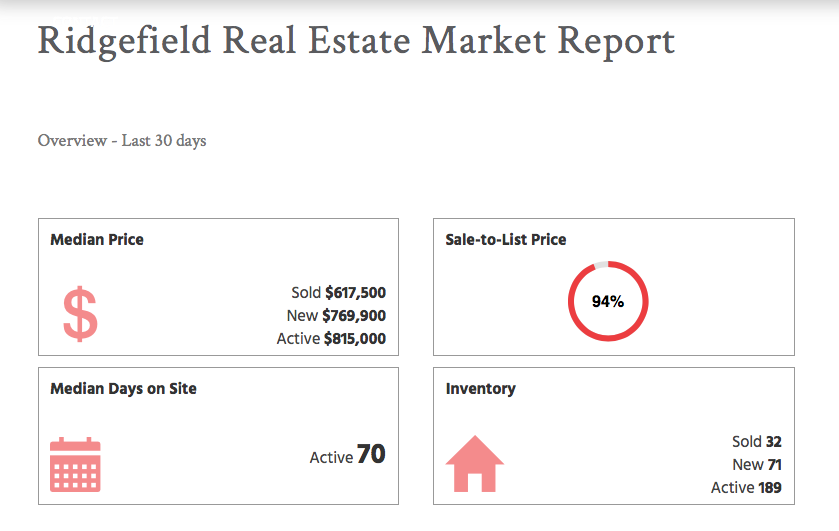

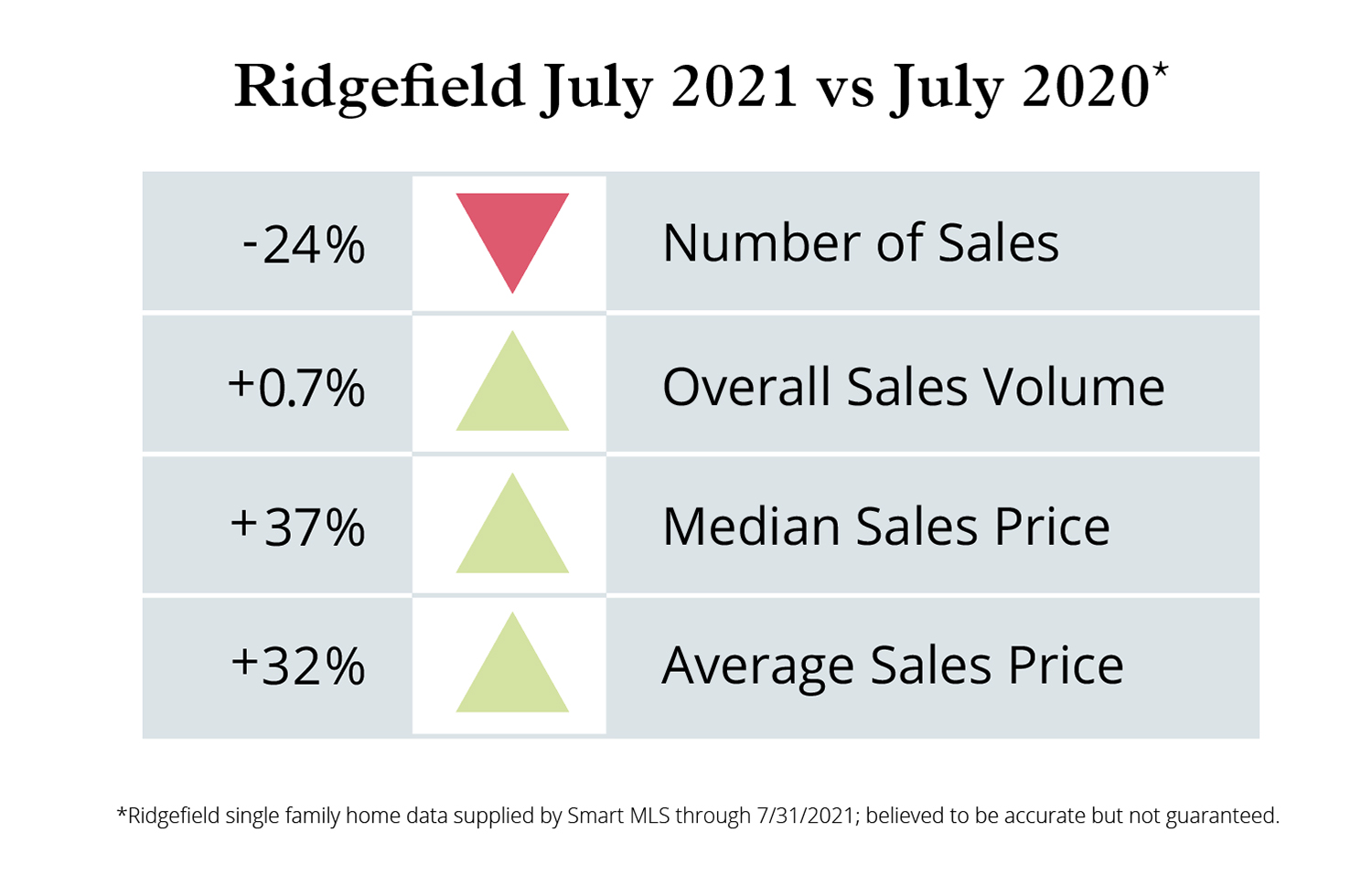

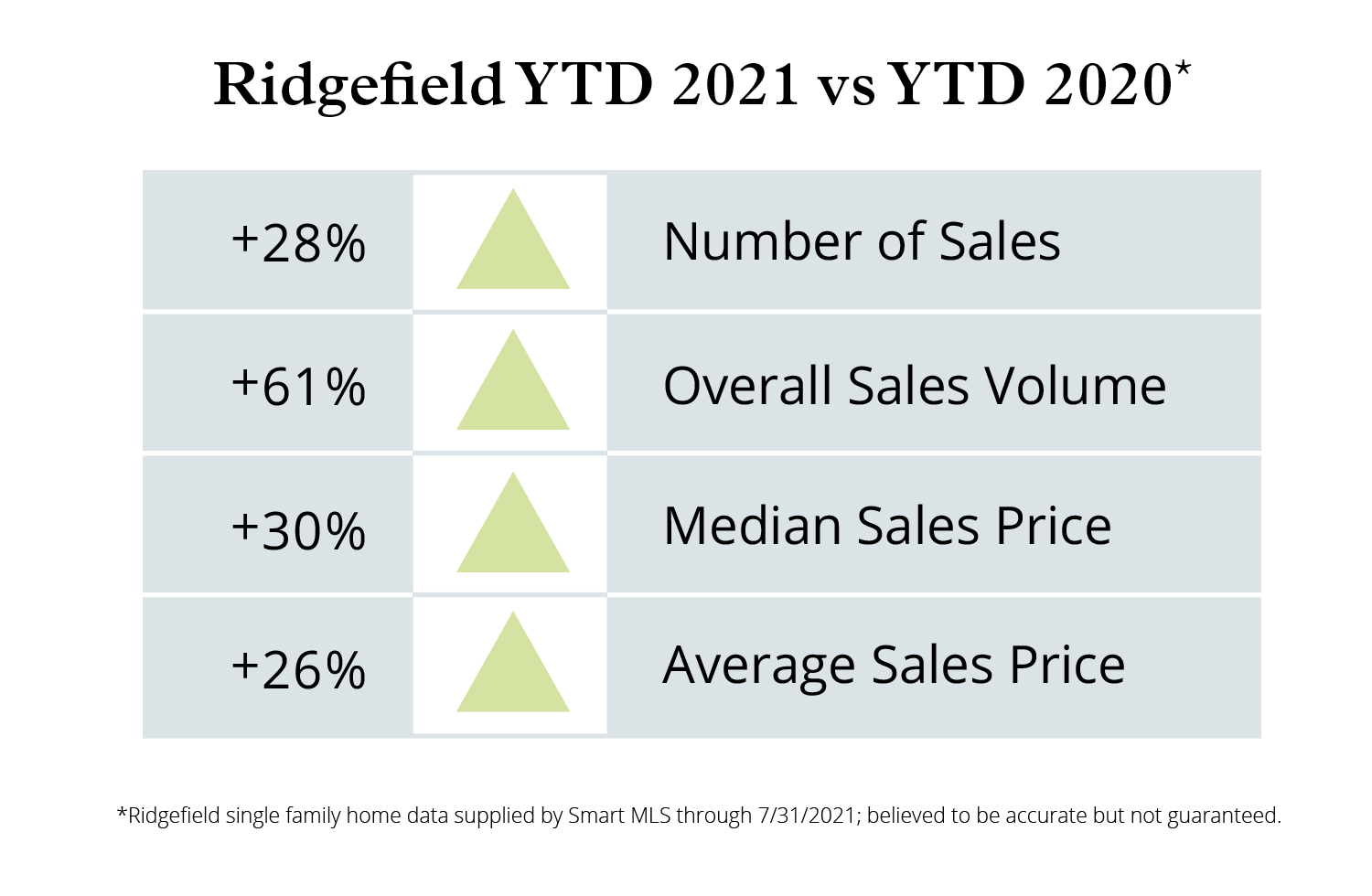

2020 was an unusually busy year for real estate across the entire nation with low inventory and high numbers of buyers. As we enter the second half of 2021, we are seeing a slight slowdown in the number of sales happening and a return to seasonality in the market. This is understandable given people are once again taking vacations. July saw the number of unit sales decrease from 72 in 2020 to 55 in 2021. Year-to-date sales stayed elevated however with 292 homes closing in 2021 compared to 229 last year (an increase of 28%).

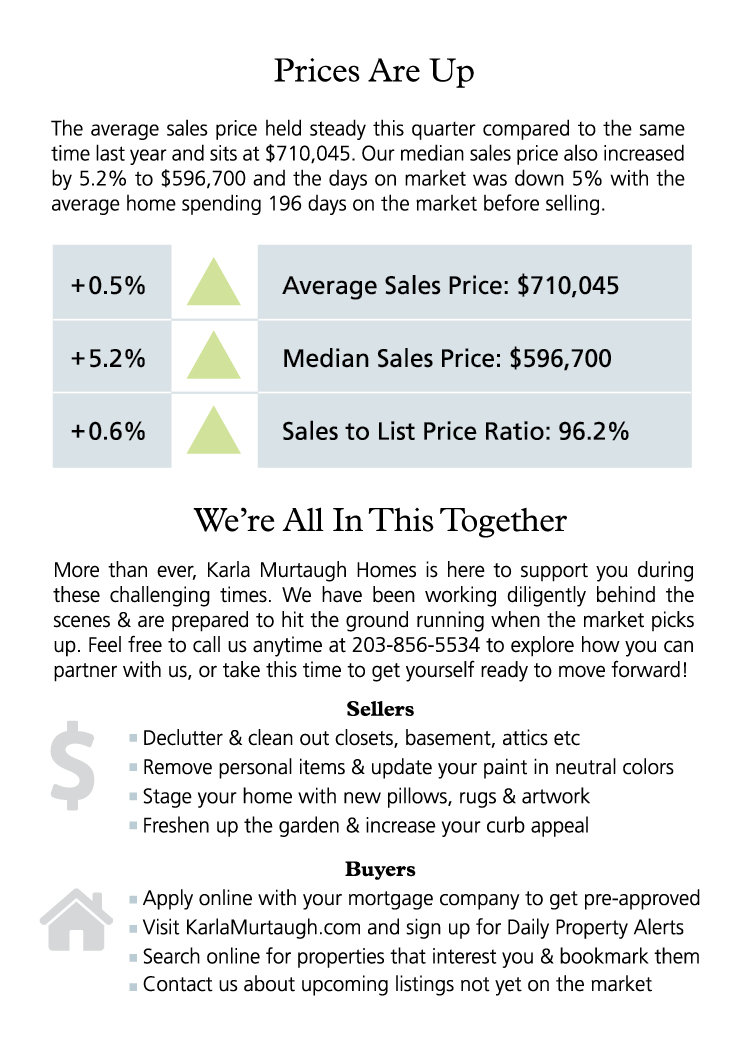

Overall Dollar Volume, Median & Average Prices Up

Due to an overall increase in price sales volume has not suffered in July despite the slowdown, staying the same at over $50-million dollars. Year-to-date sales dollar volume also increased over 2020 by a margin of 61%, with a total of $272,974,437 sold vs. $169,811,694 by this time last year. The median price of a single-family home in Ridgefield was up 30% year over year standing at $825,000 currently, and was up 37% ($875,000) when comparing July sales only, The average sales price increased 26% to $934,844 year year-to-date.

Looking Ahead

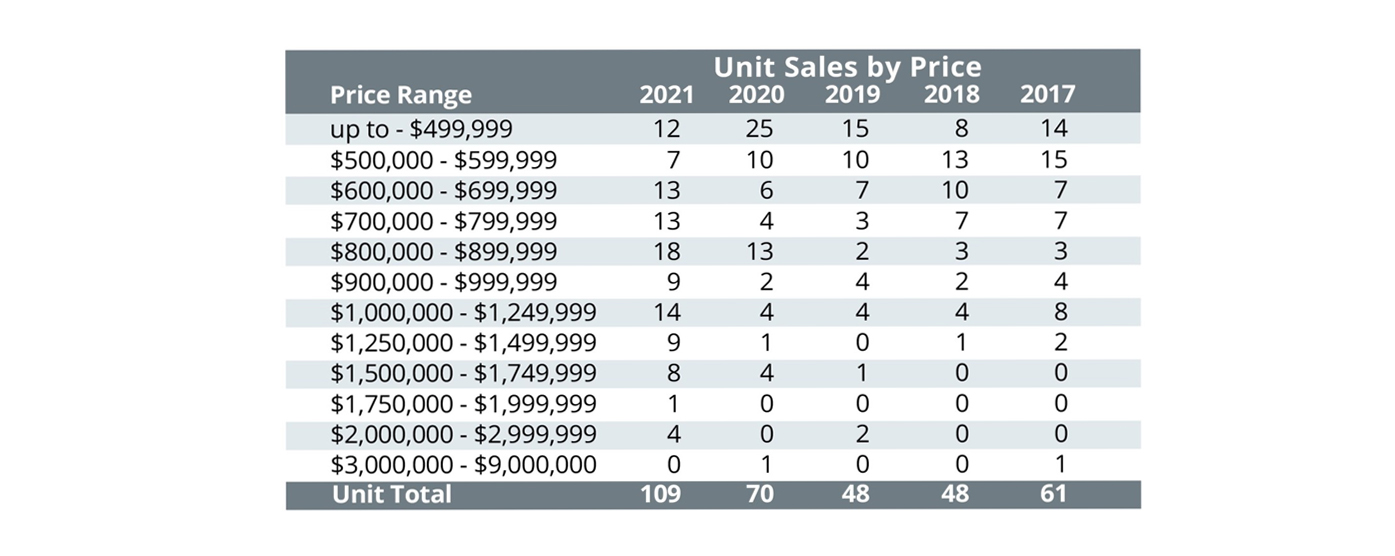

Our biggest challenge moving into Q3 and Q4 2021 is the lack of inventory. Particularly at more competitive price points ($600,000-$900,000), the lack of new homes entering the market is cause for concern. There are still buyers looking for homes, although that seems to be slowing slightly as buyer fatigue sets in. For now, homes that in good condition and are priced accordingly are still selling at or above list price, and we are seeing some multiple offer situations. It will be interesting to see how the fall market rebounds as mortgage rates continue to remain at record lows, prices stabilize and the Delta variant of Covid-19 comes into play. It does seem to be moving towards a more balanced market for buyers and sellers.

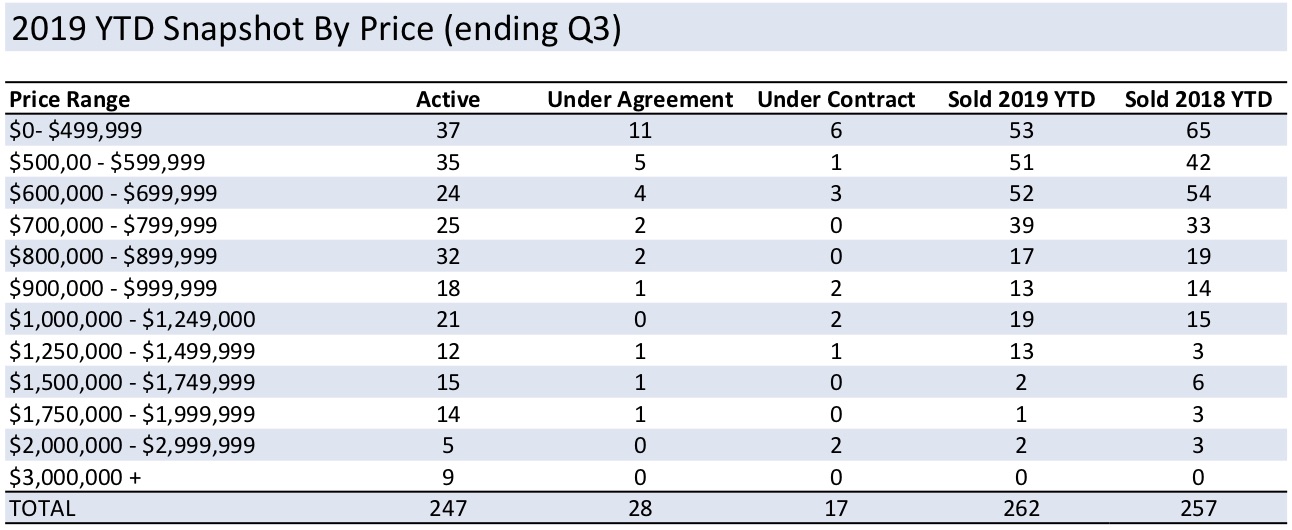

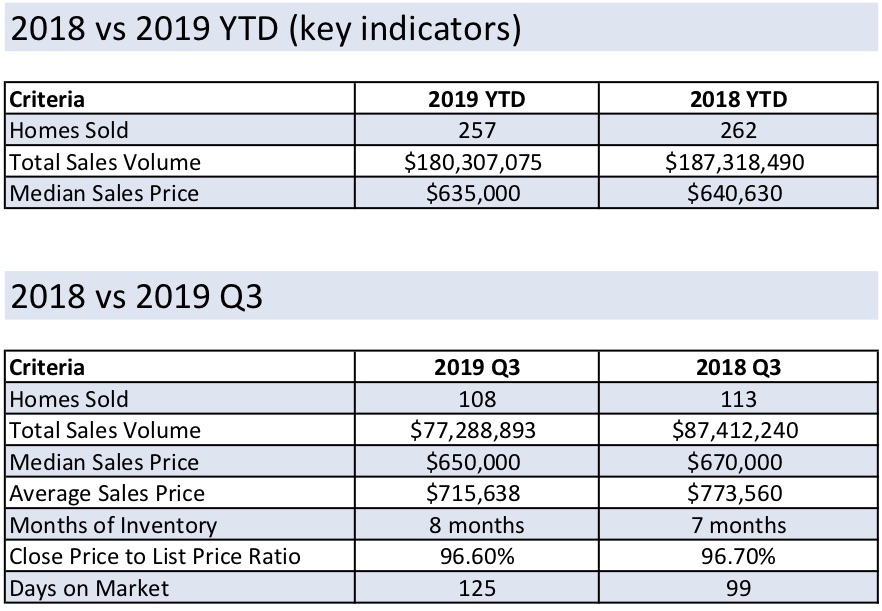

Click here to see a breakdown by price or click here to see quick summary.